feel like this needs to be said and I

don’t see anybody else saying this

anywhere else and so I guess I’ll be the

one to say it investing in real estate

for cash flow is dumb if your goal is to

be a part of the fire movement and

retire early or you want to replace your

nine to five job really real estate

investing is not the best route to go to

replace your income and cover your

expenses as quickly as possible now

before you tune me out or turn me off or

crucify me in the comments do me two

quick favors number one just hear me out

for a couple minutes because I have an

interesting point I think to make and I

would love to hear what your thoughts on

it are down in the comments and number

two if you find this intriguing maybe

share this video with a couple of your

real estate investor friends because I’d

love to hear what they have to say about

it too and if you’re one of those real

estate investor friends let us know down

in the comments let’s have a

conversation about it now before I get

too deep into bashing real estate for

cash flow I want to talk about what I do

think real estate is great for and now I

can think of three things off top of my

head there’s probably more than this and

maybe you guys can share in the comments

more things but number one I think real

estate investing is great for building

equity and therefore your net worth I

think real estate does a really great

job at that and there’s a lot of

different levers to pull that help you

do that number two is tax advantages I

think real estate has some great tax

advantages another good reason to invest

in real estate and number three real

estate can be a great source of creating

lump sums quickly so whether that’s

fixing and flipping or maybe using the

bur method and refinancing your property

and pulling money out to redeploy it

elsewhere I think real estate does a

great job at those things and like I

said there’s probably some other things

that real estate does a great job at but

cash flow is not one of them in fact I

think real estate is basically just an

insurance policy that you take out on

your property in case of something like

a 2008 crash happens and your value

drops you can maintain some positive

cash flow pay all your expenses and wait

out the dip until values rise back up to

to their normal values and you recoup

your equity and cash flow only really

comes into play in real estate when you

scale up big it’s kind of a slow method

of accumulating cash flow so let me tell

you a quick story when I first learned

about real estate investing and positive

cash flow I got super excited about I

was listening to all these podcasts and

getting super excited about cash flowing

real estate and I started doing the

mental math as I’ve been hearing more

and more about this this was kind of

after 2008 but before 2020 and uh you

know people were getting 100 200

positive cash flow a door on these

average deals and I got really excited

until I really started to think about it

and was like man how many properties do

I have to buy to replace my income from

rental properties it’s going to take me

forever that’s so many properties to buy

and to manage and all those things and I

got kind of discouraged to be honest

with you maybe you’ve had similar

thoughts Maybe not maybe you’re on that

path and you’re gung-ho go for it I’m

not saying don’t do it but I’m just

saying it’s just low way to go about it

investing in real estate for cash flow

so the question then becomes what’s a

better route to go than real estate

investing for cash flow well I’m gonna

make the case to you in just a second

that small businesses in general and

specifically of course Jordan from

laundromat resource that laundromats are

a far better way of accumulating cash

flow if your goal is to retire early or

your goal is to leave your nine to five

job or even if your goal is to maximize

your cash flow returns I think

laundromat is a far better investment

than real estate now you may be

wondering why is that why would a

laundromat be a better cash flowing

investment than real estate and it all

comes down to the way that laundromats

or small businesses are valued versus

the way that real estate is valued let’s

jump over the Whiteboard real quick and

let me show you an example of what I

mean okay so if the cash flow potential

of real estate and laundromats is rooted

in how they’re valued let’s talk real

quickly about how each one of them are

valued real estate we need to break into

two different different categories

number one is residential real estate

and residential real estate’s typically

value based on comparable sales what

everything around it is valued that’s

similar and it really has no correlation

to the income potential of that property

commercial real estate on the other hand

is based on what’s called a

capitalization rate that’s applied to

the net income of that property now I

don’t want to get too deep into the

woods of how commercial real estate is

valued but as a quick explainer

capitalization rate or cap rate is the

amount of net income you could expect if

you bought a commercial property with

all cash so for example just a quick

simple easy one if you find a commercial

real estate property for a hundred

thousand dollars and the capitalization

rate is eight percent then you could

expect eight thousand dollars of annual

net income from that property

laundromats are valued similarly to

commercial real estate except for

instead of using a capitalization rate

we use a multiple and it’s basically

just the inverse of the cap rate so in

our example we have eight thousand

dollars of net income for a commercial

property if you divide that by .08 or

eight percent or cap rate you’re gonna

get a hundred thousand dollars for a

laundromat however instead of dividing

by point eight percent in this example

we would multiply it by 12.5 and that

would give us a hundred thousand dollars

that’s just the inverse of .08 and the

way you could get there if your mind

works in capitalization rate is just one

divided by the capitalization rate so

one divided by .08 is 12.5 so if you

multiply eight thousand dollars times

twelve point five you’re gonna get your

hundred thousand dollars now I just said

that as a little bit of background if

you’re not tracking with me no worries

don’t worry we’re going to do an example

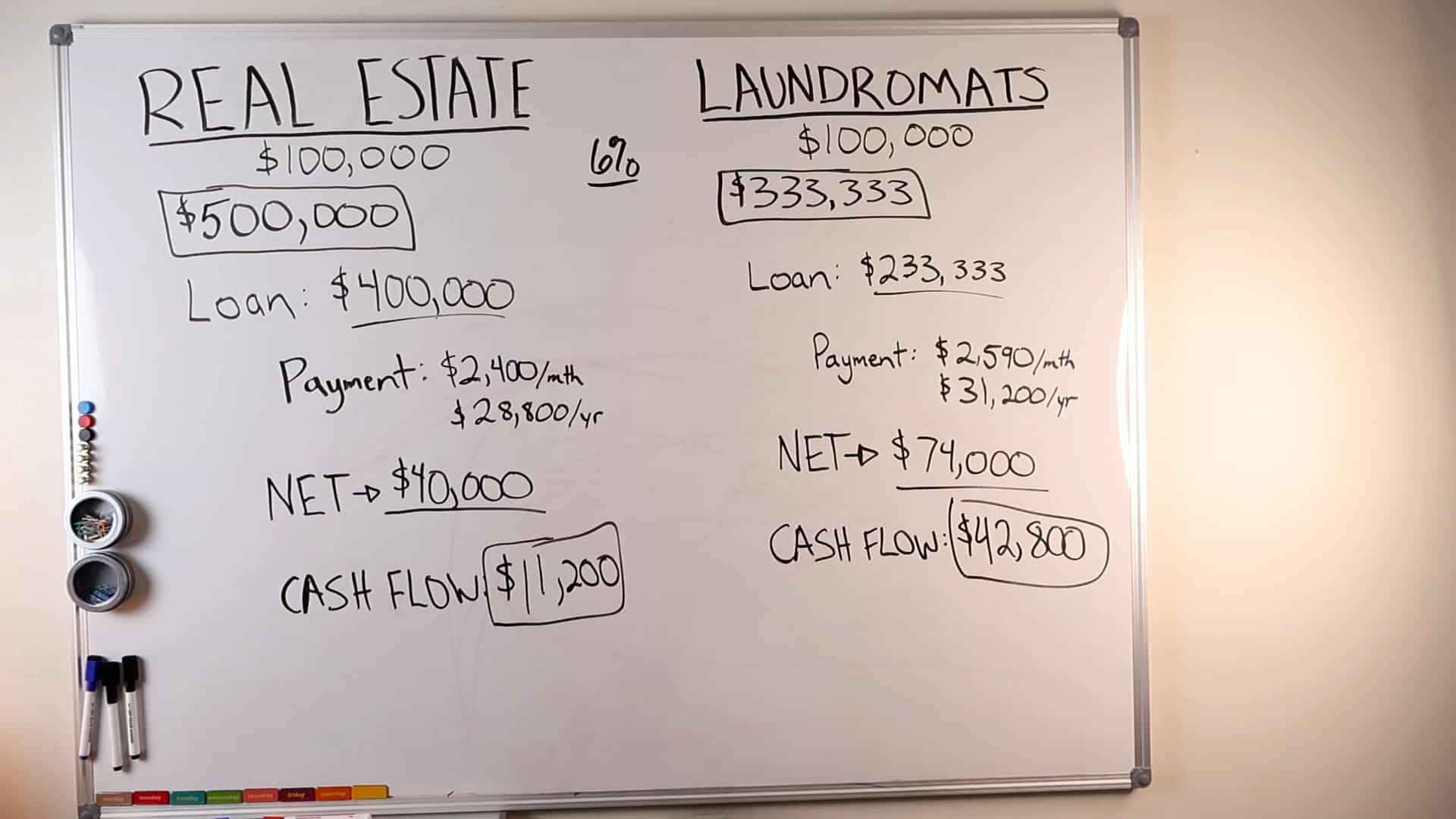

right now all right let’s say that you

you have a hundred thousand dollars to

invest in either real estate or

laundromats and you’re looking for cash

flow what should you do with that

hundred thousand dollars great question

let’s let the numbers decide now if you

want to buy real estate you could

probably get a loan with 20 down so with

your hundred thousand dollars if you put

all that down you could buy a property

worth five hundred thousand dollars with

laundromats however typically you’re

gonna need about thirty percent down for

your first deal so that means you could

buy a laundromat for 333

333.33 so as you can see you can buy

more real estate than you can

laundromats for your hundred thousand

dollars all right we’re gonna use a six

percent interest rate for our loans now

they’re all over the place right now but

as long as they’re the same we can kind

of make an Apples to Apples comparison

so six percent interest rate you’re

gonna have a loan on your real estate of

four hundred thousand dollars with your

hundred thousand dollars down and on

your laundromat you’re gonna have a loan

of two hundred and 33

333.33 with your hundred thousand

dollars down so here’s what your loan

payments are gonna look like for the

real estate and for the laundromat

foreign

so for Real Estate we’re going to have a

monthly payment of twenty four thousand

dollars a month which is 28 800 annually

for your loan payment for your

laundromat you’re going to have a loan

payment of two thousand five hundred and

ninety dollars per month or Thirty one

thousand two hundred dollars per year

now here’s where things kind of get

interesting okay so let’s go back to our

real estate deal and say we get a pretty

average return on investment which I

would say is about eight percent cash on

cash return on investment now I’m aware

that there’s other ways to create value

in real estate for example tax

deductions uh building equity loan pay

down all that stuff but we’re talking

about cash flow we’re talking about

exiting your nine to five getting

Financial Freedom talking about cash

flow here so eight percent cash flow is

a pretty average deal you should be able

to find a real estate deal that has

about eight percent return on your money

that means based on a valuation of 500

000 and an eight percent return on your

real estate State investment that means

based on a five hundred thousand dollar

investment in a real estate property

that has an eight percent return you can

expect about forty thousand dollars of

net income before your loan payments in

the real estate deal now we talked about

how laundromats are valued but I didn’t

mention the best part yet and the best

part of laundromat valuation is what the

multiples are in order to determine the

valuation of a laundromat so I mentioned

before that eight percent pretty average

return on investment for a real estate

investment that’s a 12.5 times the net

income multiple the average multiple for

a laundromat however is not 12.5 it’s

not 10 it’s not eight in fact the

average multiple is somewhere between

three and a half and five times the net

income that means in your average deal

you’re getting somewhere between a 20

and 25 percent return on your money on

Leverage without using a loan however we

are using a loan in this example so

let’s talk about what that means let’s

to use an average deal an average

multiplier to determine what kind of

cash flow we can expect from this

particular laundromat so we won’t use

like a 3.5 or even a four let’s use a

4.5 multiplier which means we’re going

to take our purchase price and divide it

by 4.5 that’s going to leave us with the

net income that we can reasonably expect

from this laundromat at 74 074 so let’s

round it to 74 000 of net income before

our loan payments for the laundromat

okay already we’re looking pretty good

at forty thousand dollars of net income

for the real estate investment and

seventy four thousand dollars of net

income for the laundromat however we

still have to apply our loan payments so

once we subtract our 28 800 from our

forty thousand dollars of net income we

get a cash flow of eleven thousand two

hundred dollars that’s not bad leverage

that’s an 11.2 percent return on our

hundred thousand dollars that’s pretty

good however when we take a look at our

cash flow from our laundromat we can see

that once we subtract the thirty one

thousand two hundred dollars from our

seventy four thousand dollars of net

income we get a whopping 42 800 dollars

that’s a 42.8 return on our original 100

000 investment now I don’t know about

you but 11.2 sounded really nice there

for a second until I learned that

leveraged I could get a 42.8 return on

my money for an average laundromat deal

this is not even a home run deal it’s an

average deal this example right here of

an average real estate deal and an

average laundromat deal is exactly why I

say buying real estate for cash flow is

just dumb and slow buy yourself a

laundromat or to replace your income as

quickly as possible and then start

plowing some of this cash flow into the

real estate to build up the equity and

your net worth in the real estate

properties I’m Gonna Leave a shot of

this in case you want to screenshot it

and take a look at it a little deeper

and then I’ll close this thing out if

you want to take a quick screenshot so

you can take a closer look here you go

okay we’ve run the numbers we’ve done

the math now I’m curious what do you

think do you think real estate cash flow

is still a better way to go or are you

interested in considering a laundromat

if your interests have been Peak number

one let us know down in the comments

number two check out the link that’s in

the description below and in the pin

first comment and go check out the free

course on how to buy your first

laundromat it’s three lessons long

jam-packed with great information and

let’s get started on your laundromat

Journey but if you’re not quite quite

sold yet on how great laundromats can be

for your business then check out this

video right up here because it’s going

to give you 10 reasons why laundromats

are the best investment you can make